In-store retail media networks — The revolution 2.0

In-store retail media networks are gaining momentum as brands realize most purchases still happen in physical stores. While digital channels get the bulk of retail media spend today, in-store environments offer untapped potential for reaching shoppers right at the moment of decision. This guide breaks down why in-store RMNs matter, how they’re evolving and what national and regional retailers — along with CPG marketers — need to know to compete and win.

August 28, 2025

Table of contents

Think retail media advertising is a digital invention? Think again.

The idea at the heart of retail media networks — that retailers should be thinking of, and leveraging, their shoppers as audiences — is a lot older than people realize.

The current retail media network boom is technically a dozen years old, starting with Amazon's launch into the space in 2012, followed over the years by many of the biggest brick-and-mortar players, from Walmart to Target to Costco. But the truth is that canny retailers have been creating and delivering media to their audiences for ages — starting with, at the most basic level, frequently refreshed in-store signage and displays.

And while modern-day retail media networks rightfully get credit for strategically leveraging digital/e-commerce channels, "traditional" retail media, so to speak, was certainly multimedia/multichannel in its own way.

Grocery store circulars that incorporate recipes and tips from the butcher and the baker? That's print media marketing (and, of course, content marketing). In-store cooking classes and department store fashion shows? Experiential marketing. "Attention shoppers" announcements? Audio marketing. Store window displays? Out-of-home marketing that became, literally, an art form.

Though modern-day retail media marketing has brought scale and digital rigor to shopper-targeted media, it's helpful to remember what tends to motivate consumers — like the pleasure of the perfect "find" or the thrill of a deal — has remained largely constant over the years. Some of the technologies and channels have changed, sure, but a shopper is a shopper is a shopper.

An effective in-store RMN activation can serve as the nudge that can prompt a shopper to try one brand instead of another.

That’s why this is such an exciting moment in the evolution of modern retail media networks: Now that the biggest big-box players have spent years proving out the value of monetizing and motivating audiences primarily across online/digital channels (typically on retailers’ websites and apps), fresh attention is being showered on in-store audiences.

And that new in-store focus, combined with the latest technologies and shopper marketing strategies, are not only giving regional and midsize retailers a fighting chance in the RMN space against the national retail giants, but also providing innovative new opportunities for CPG brands to reach some surprisingly elusive audiences in the moment, as they’re ready to buy.

Here’s what marketers need to know now …

Spending on in-store retail media advertising is exploding — but there’s still a lot of room for it to grow

According to eMarketer, in-store retail media advertising spend in the U.S. is projected to grow from $370M in 2024 to $1.06B by 2028 — nearly tripling in four years.

However, this is still a small fraction of the total retail media market, which will surpass $100B by 2027. The opportunity for in-store digital marketing is massive.

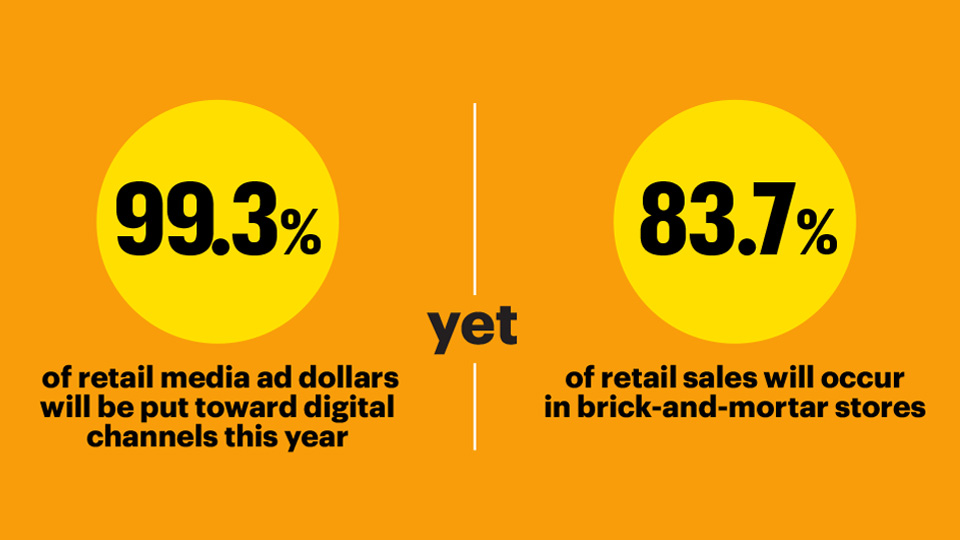

“Almost all (99.3%) of retail media ad dollars will be put toward digital channels this year, per our March 2024 forecast,” says eMarketer’s Meaghan Yuen. However, the majority of retail sales (83.7% this year) will occur in brick-and-mortar stores, highlighting an opportunity for retailers to integrate more digital media into their customers’ in-store buying journey.”

As Quad’s Senior VP of Strategic Retail Initiatives Kevin Bridgewater puts it:

“There’s a massive disconnect between where the majority of sales are taking place — in physical stores — and where brands have been able to reach consumers digitally. Until recently, there just hasn’t been enough inventory, but with In-Store Connect by Quad, we’re massively scaling the opportunity for brands to buy the in-store environment.”

CPG marketers in particular, Bridgewater notes, “are thrilled to be able to fish where the fish are biting, and to be able to do so digitally, dynamically and at scale.”

Regional retailers are winning loyal foot traffic

As Grocery Dive reported earlier this year, an analysis of U.S. retail foot traffic by Placer.ai found that while national supermarket companies loom large in the grocery sector, regional and specialty stores are drawing a “commanding” share of highly devoted customers.

That’s because, as big as the giants are, many consumers remain devoted to local/regional grocers. As Grocery Dive notes, the “10 most-visited chains together only comprise 42.6% of total grocery visit share for last year,” according to Placer.ai’s data.

So while big-name retail media networks dominate headlines, regional grocers and specialty retailers are holding strong — and innovating.

In-store digital marketing meets the moment of purchase

Unlike e-commerce, where carts can be abandoned, in-store shoppers are ready to buy. An effective in-store RMN can connect with shoppers by:

“Consumers in-store are hungry for information,” says Ashley Wacht, Head of Product Marketing, CPG at Quad. “Smart in-store digital marketing provides it — at shelf, in real time.”

Read more: 5 ways that retail media advertising connects with shoppers

Consumers are already merging e-commerce shopping habits with brick-and-mortar shopping behaviors

Just 33% of consumers shop in physical stores without digital assistance, according to PYMNTS’s 2024 Global Digital Shopping Index. “In some cases, consumers are going online to prep for a shopping trip before they ever set foot in a store,” says Wacht, “but increasingly they’re using their smartphones in-store as a sort of shopping companion or concierge. Grocery shoppers in particular are hungry for information — about everything from recipe ingredients to meal ideas to discount offers.”

The bottom line: Consumers are already, on their own, seeking to combine the benefits of e-commerce shopping with their in-store experiences, says Bridgewater. In-store RMNs reduce some of the friction of that combination “by deploying high-impact, in-the-moment smart digital displays that bridge physical and digital consumer connections,” he says.

“In other words, retailers and CPG brands can proactively give consumers the information they want — right there, in real time, at the shelf — without them having to search for it on their devices.”

In-store digital marketing is about more than just prompting “impulse shopping”

Yes, in-store retail media can prompt impulse purchases — and the stats prove it:

“The data about impulse shopping is compelling, but it’s not exactly surprising,” says Christy Eicher-Bywell, VP of Strategic Retail Initiatives at Quad, “because we’ve all bought more than intended on grocery shopping trips.”

But the term “impulse,” she adds, can be a bit of an oversimplification. “Shoppers tend to make unexpected purchases not only because of sudden desires — a craving for a snack, for instance — but because of needs.

“The best use of in-store retail media networks is not to ‘trick’ consumers into buying something, but to meet them where they are in terms of their lifestyles. Whether a given consumer is looking for a more convenient meal option, a healthier snack or a more affordable ingredient, a well-executed in-store RMN campaign can serve as a real value-add to the customer shopping journey.”

What makes a great in-store retail media network?

“In 2024, in-store RMN is not about slapping a bunch of off-the-shelf flat screens on endcaps that blare at shoppers,” says Bridgewater. “With In-Store Connect by Quad, we’ve assembled a purpose-built hardware-meets-software solution that seamlessly integrates into retail environments. We’re all about serving the needs of all the stakeholders: the retailer, the CPG marketer and especially the shopper.”

In-Store Connect by Quad combines:

According to Lily Wen, Director of Product Marketing – Data & Media at Quad: “Doing in-store RMN right involves a marriage of art and science. It takes deep, real-world experience with diverse retail environments to expertly deploy in-store RMNs, because every retailer has different priorities, product mixes, floor plans and varied customer/audience needs.

“That’s why every In-Store Connect partnership starts with Quad auditing your environment, collaborating on planning a solution and then carefully monitoring the impact to determine what’s working and what’s not.”

Common questions: Retail media networks FAQs

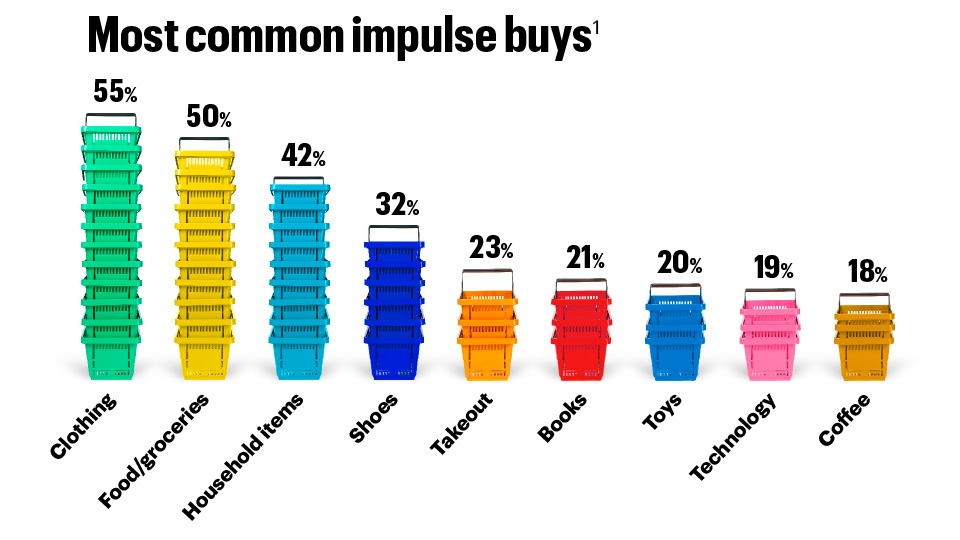

Shopper marketing strategies: The impulse buy play

Impulse buying is a measurable part of the brick-and-mortar shopping experience which is part of the reason why in-store retail media networks are so hot right now. Savvy in-store shopper marketing strategies help consumers discover — or rediscover — products that may not have been on their shopping lists.

The amount spent by the average U.S. consumer on impulse purchases in 2023, per research from Resonate

The most common impulse buys, per Slickdeals 2023 survey:

Other impulse shopping stats:

Sources:

1. Slickdeals' 2023 survey of 2,000 American shoppers conducted by One Poll

2. Resonate's 2023 "The Current State of Brick-and-Mortar Retail Customers" report

About Quad

Quad (NYSE: QUAD) is a marketing experience, or MX, company that helps brands make direct consumer connections, from household to in-store to online. The company does this through its MX Solutions Suite, a comprehensive range of marketing and print services that seamlessly integrate creative, production and media solutions across online and offline channels. Supported by state-of-the-art technology and data-driven intelligence, Quad simplifies the complexities of marketing by removing friction wherever it occurs along the marketing journey. The company tailors its uniquely flexible, scalable and connected solutions to each clients’ objectives, driving cost efficiencies, improving speed-to-market, strengthening marketing effectiveness and delivering value on client investments.

Quad employs approximately 11,000 people in 11 countries and serves approximately 2,100 clients including industry leading blue-chip companies that serve both businesses and consumers in multiple industry verticals, with a particular focus on commerce, including retail, consumer packaged goods, and direct-to-consumer; financial services; and health. Quad is ranked among the largest agency companies in the U.S. by Ad Age, buoyed by its full-service media agency, Rise, and creative agency, Betty. Quad is also one of the largest commercial printers in North America, according to Printing Impressions.

For more information about Quad, including its commitment to operating responsibly, intentional innovation and values-driven culture, visit quad.com.