Podcast advertising from one of the nation's largest credit unions. Social media videos from a multistate bank with 1,100 branches. A short film from the nation's oldest auto and property insurer. Full-page newspaper ads from a regional bank.

If it seems like you're seeing marketing appeals from financial services companies across an ever-expanding set of channels, that's because you are.

Recognizing that consumers are more elusive and harder to reach than ever, financial services providers across the board are expanding their investments in omnichannel marketing.

In 2024, brands in banking, insurance, credit cards, accounting and related sectors are expected to increase advertising spending by 11.5% — more than their counterparts in any other sector — according to projections from WARC. That aligns with a Quad survey finding that 66% of financial marketers were anticipating increased budgets this year.

Adopting an omnichannel mindset — in financial services and other sectors — is increasingly challenging as audiences fragment, channels multiply and technology shifts occur seemingly overnight. Success across channels today almost requires marketers to defy the laws of the universe: to share their messages more widely while also personalizing them to develop targeted, meaningful and engaging relationships.

"You have to have the right data and understand exactly who you are talking to," says Devon Craig, Head of Financial Services Marketing at Quad. "It's one thing to just be on a 'hot' platform, but is it where your audience really lives? Is that where you can effectively offer them value and meaning?"

Complex pathways to financial services customer engagement

One of the greatest challenges in omnichannel marketing for financial services lies in understanding shifting customer behaviors among the post-baby boom generations, research shows. Next-generation customers are not just expecting more financial services brand touchpoints, they are demanding them. And they want these touchpoints to be genuine.

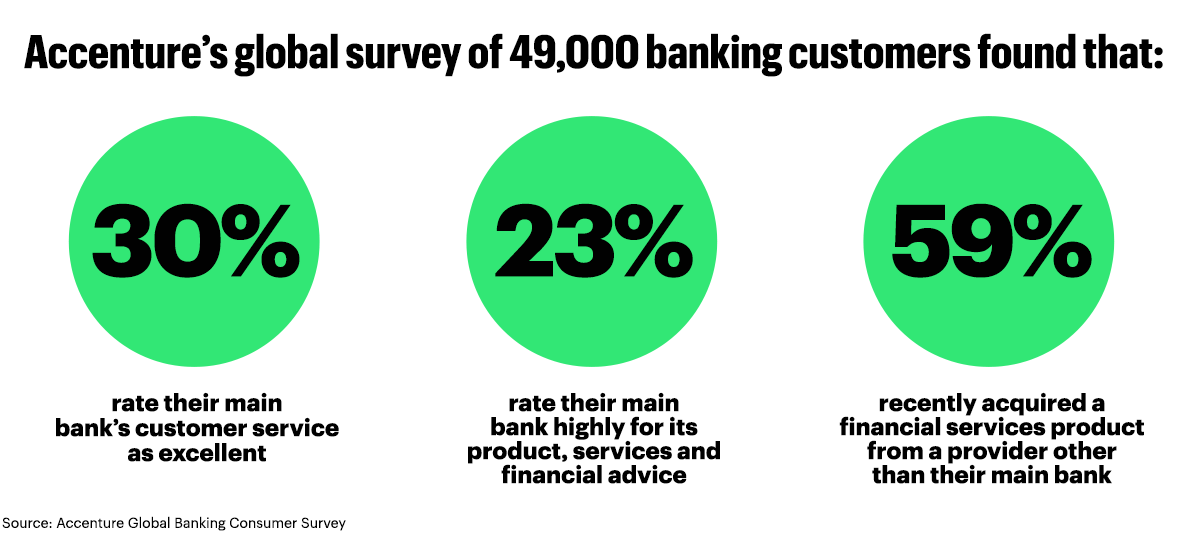

A majority of financial customers believe they should be able to engage with their institutions using any channel and switch between them seamlessly, according to the 2023 Accenture Global Banking Consumer survey. Unfortunately, as Accenture notes, “most digital channels today are less than helpful in forging personal connections with customers.”

As a result, banks "need to embark on a journey of perpetual renewal" to reverse alarming trends uncovered by Accenture in its survey of 49,000 global consumers: only 30% of consumers rate their bank's customer service as excellent; only 23% rate their bank highly for its products and services and financial advice; and 59% report having turned to financial services providers outside mainline banking.

How to use omnichannel marketing finance to boost consumer engagement:

- Understand your target audience across channels

- Leverage data for personalized experiences

- Align your goals with your consumers' pain points

- Use physical and digital experience

- Analyze (and optimize) channel performance based on data

- Boost support through omnichannel integration

Addressing these challenges requires a data-driven marketing strategy that engages customers across all channels, including both digital and physical media, Craig says. But the real challenge is to produce a seamless feel, no matter where the customer engages. "How can you make omnichannel feel like a seamless, single channel?" she says.

New channels and technologies complicate customer journeys

The steady growth of marketing channels has opened a mind-boggling number of engagement and purchase pathways for customers. A 2023 McKinsey study found that the average regional bank offers more than 1,500 separate customer journeys when factoring in business units, geographies, product lines and services. Some of those journeys need to be streamlined, McKinsey said, while still others need to be fully reimagined to align with current trends.

At the individual level, McKinsey found that the typical financial services customer interacts with brands across an average of six different channels. Multiply that by of an increasing number of devices — everything from personal computers, laptops, tablets and mobile phones to smart speakers, smart watches, VR headsets and more — and 1,500 journeys sounds just about right.

Quad’s proprietary research indicates that financial services marketers have recognized the diffuse nature of today’s customer journeys and are responding accordingly. About three of every four financial marketers (72%) responding to a 2023 Quad survey said they invest ad dollars in social media, TV and email marketing. About half advertise using search and display ads (50%), direct mail (53%), mobile and text messaging (48%) and radio (also 48%).

Quad’s research also shows an increasing number of financial services marketers are extending their investments by integrating with direct mail campaigns.

To make matters even more complex, other market research indicates that younger consumers, especially members of Generation Z, have an increasing affinity for using brick-and-mortar bank branches, further highlighting the critical importance of omnichannel approaches.

By focusing across channels and developing meaningful and engaged relationships, financial services providers can position themselves for more success, according to Accenture’s research — for banks alone, potentially boosting revenue by up to 20%.

Yet often that’s a lot easier said than done, says Todd McNab, Vice President of Client Strategy at Quad, especially given that the financial services field is highly competitive, with a lot of players trying to get the attention of customers often besieged by offers.

“While customers are clamoring for personalized, relevant, custom experiences, they’re inundated with almost innumerable messages across countless channels,” McNab says. “This is happening even though customers are sharing record levels of data with brands around their preferences and brands have access to performance metrics and technology that should enable specific paths versus the blanket coverage that’s often applied.

“In conversations we’re having with clients,” McNab continues, “they understand that they’re not delivering the best experience or honoring what the data, the martech or the customers themselves are telling them. They’re looking for tangible assistance in planning, setting up the journeys, operationalizing them and then unlocking the insights.”

The exciting part of the challenge is that the tools of the digital age allow brands to create an intimate feeling for customers at scale, says Erin Slater, Head of Financial Services Strategy at Quad. “The potential is huge in leveraging data to personalize communications at every touchpoint,” Slater says. “That means banks and institutions can deliver tailored advice, relevant product recommendations and an overall experience that makes customers feel understood and valued as individuals. It’s a way of turning commoditized transactions into long-term relationships.”

Personalize financial services marketing — with feeling

One of the best ways to forge those relationships, Quad’s Craig says, is for financial services marketers to consider their customers’ emotional motivations for engaging with various financial products and services. And many brands, encouraged by research showing that 72% of consumers consider personalization crucial, clearly understand that imperative.

Craig says that in some ways, the personalization of financial services marketing represents a “back to the future” moment. Insurance and banking formerly thrived on human connections, such as the community bank employee who ensured you didn’t borrow beyond your means or a neighborhood insurance agent helping personally tailor and adjust coverage as you grew older.

Then the financial services industry grew big and global, and the essential one-on-one connections became less central and gave way to more transactional and even sterile interactions.

But today, Craig says, technology offers a “pendulum shift” back toward personal engagement. Brands now have more sophisticated tools for reaching customers where they want to be reached, which helps cement long-term relationships.

Using data-driven omnichannel marketing, financial services brands can create personalized messaging that reaches across various touchpoints, at a much larger scale than ever thought possible. The result: enduring connections at a human level.

“Brands don’t have the luxury anymore to call all the shots,” Craig said. “People have a voice, and they have a million different choices. Unless financial institutions leverage omnichannel marketing to provide complete transparency and hyper-personalization, they run the risk of losing business in an intensely competitive landscape. At the end of the day, people want to feel completely secure in the knowledge that their financial providers have their backs.”